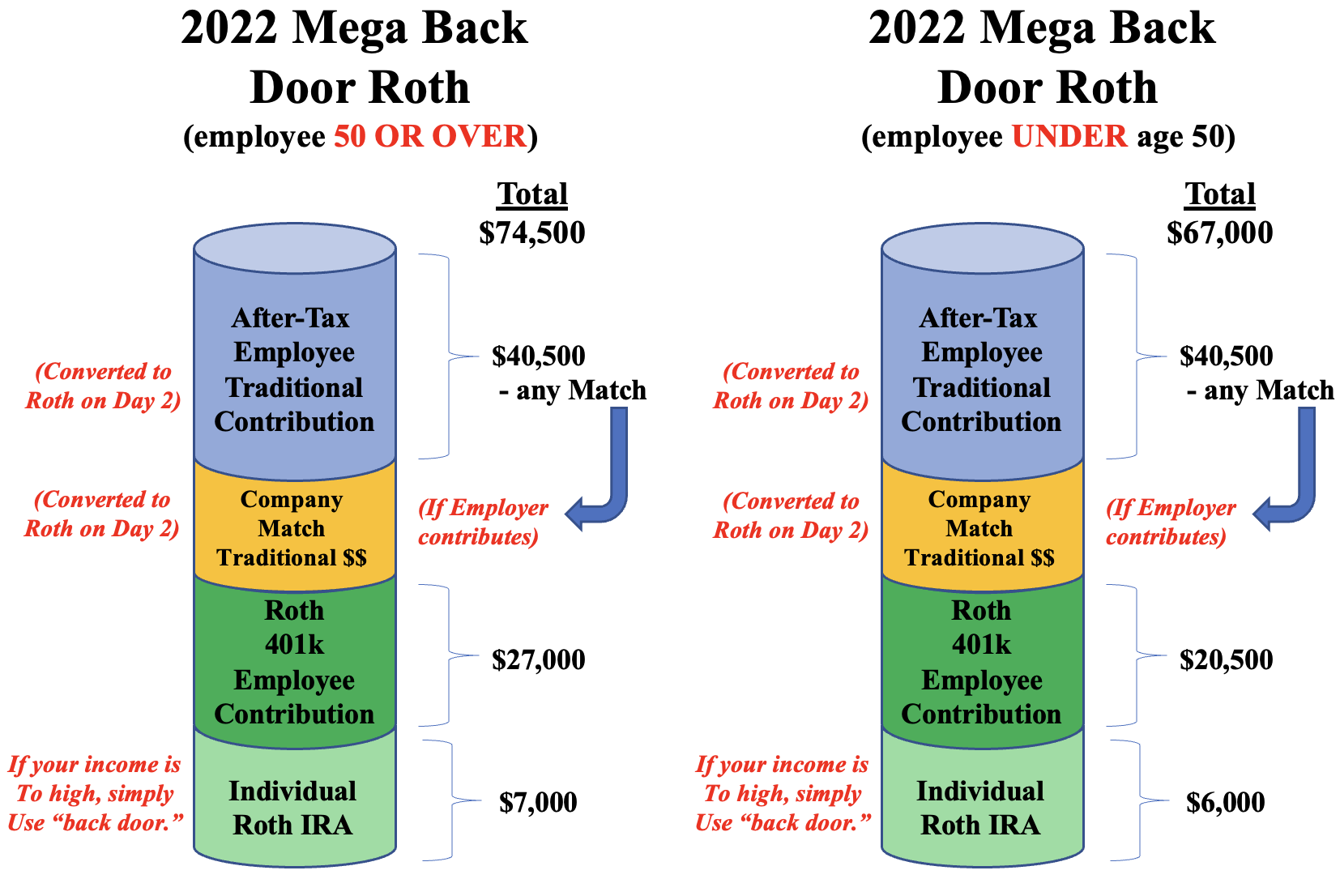

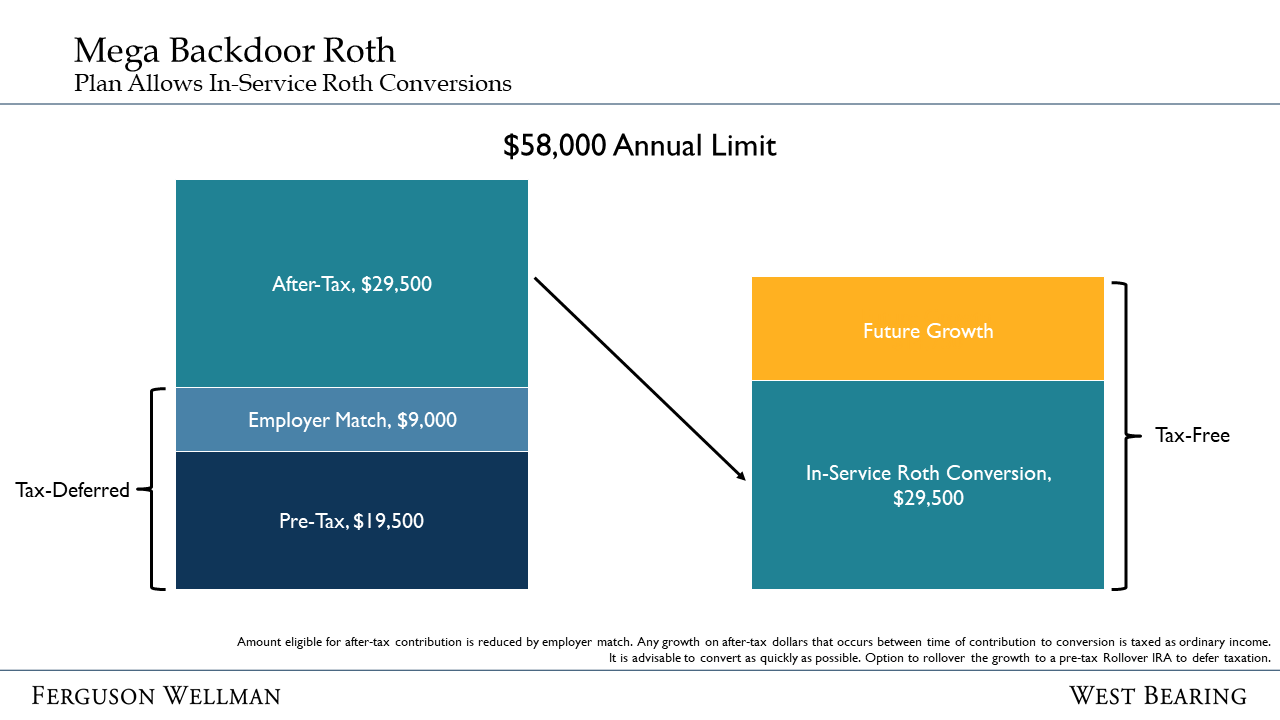

Mega Backdoor Roth Ira Limit 2024 Pdf. For employees age 50+, the limit is $26,000. Ira and 401 (k) rules disallow more than $6,000 and $19,500.

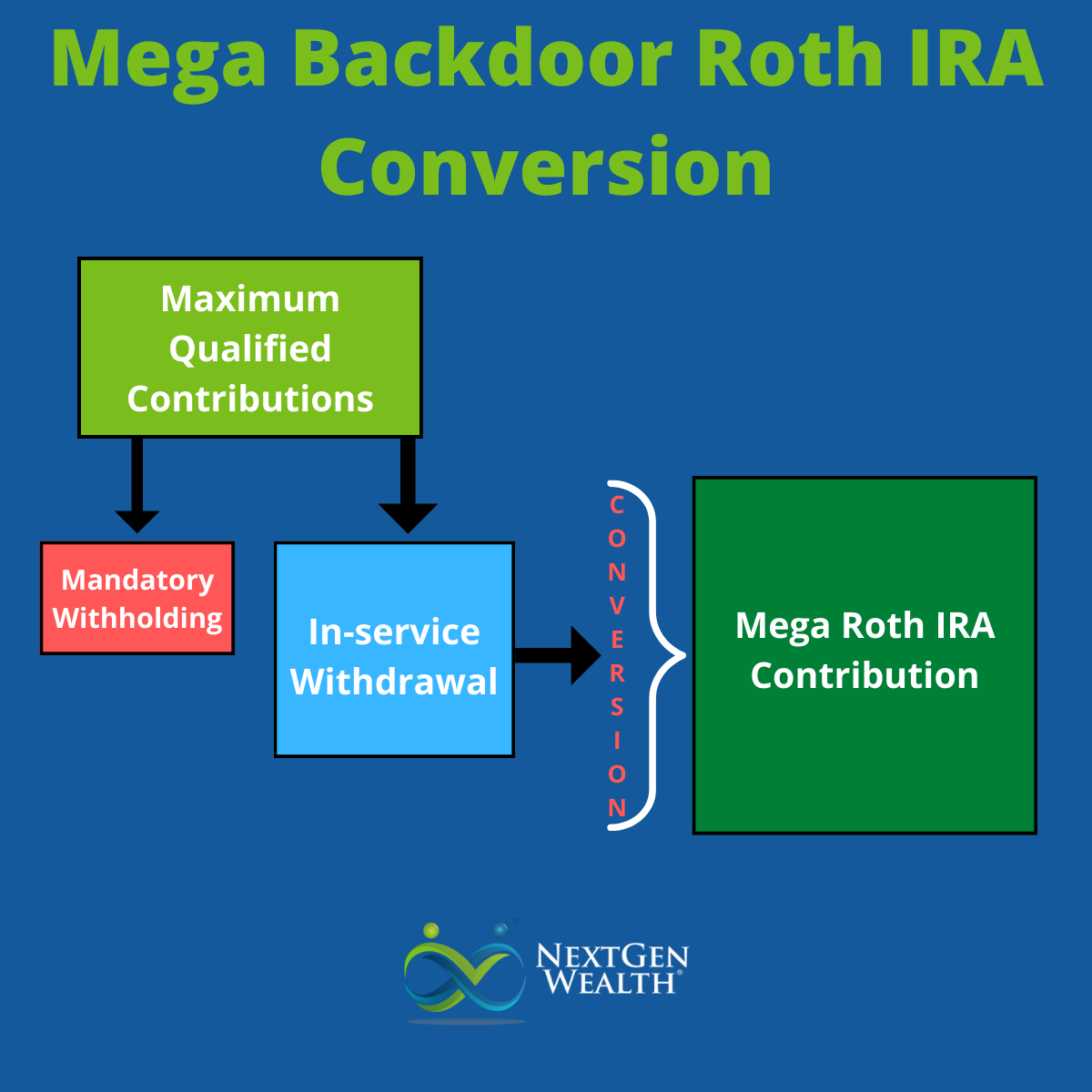

Ira access, tax breaks can phase out for high earnersiras have a $7,000 annual contribution limit. What happens if i accidentally go over my mega backdoor roth ira conversation limit?

Mega Backdoor Roth Ira Limit 2024 Pdf Images References :

Source: timmyjackqueline.pages.dev

Source: timmyjackqueline.pages.dev

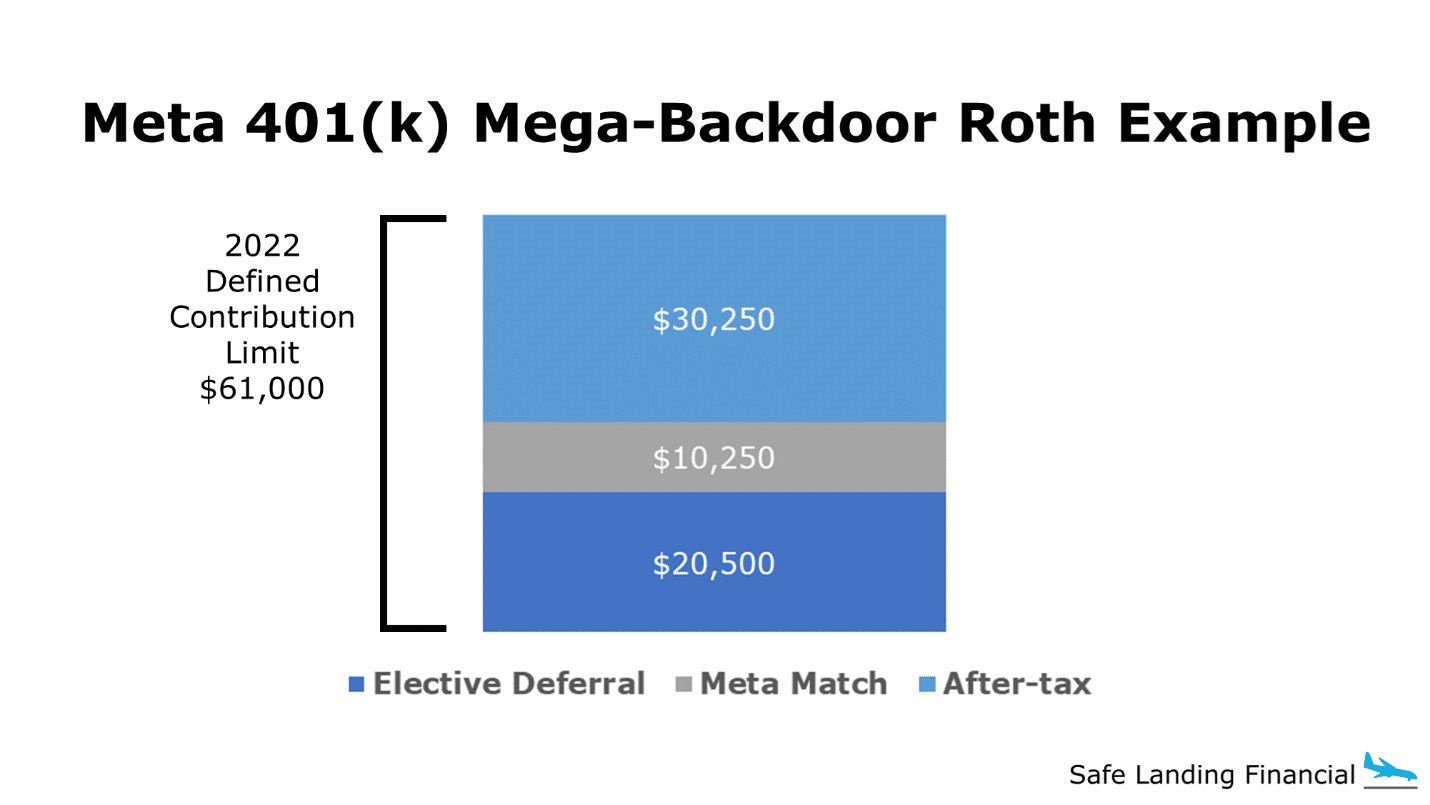

Backdoor Roth Contribution Limits 2024 Hally Kessiah, The max 401 (k) limit is $69,000 for 2024, which includes deferrals, employer matches, profit sharing and other deposits.

Source: vallyyhyacinthe.pages.dev

Source: vallyyhyacinthe.pages.dev

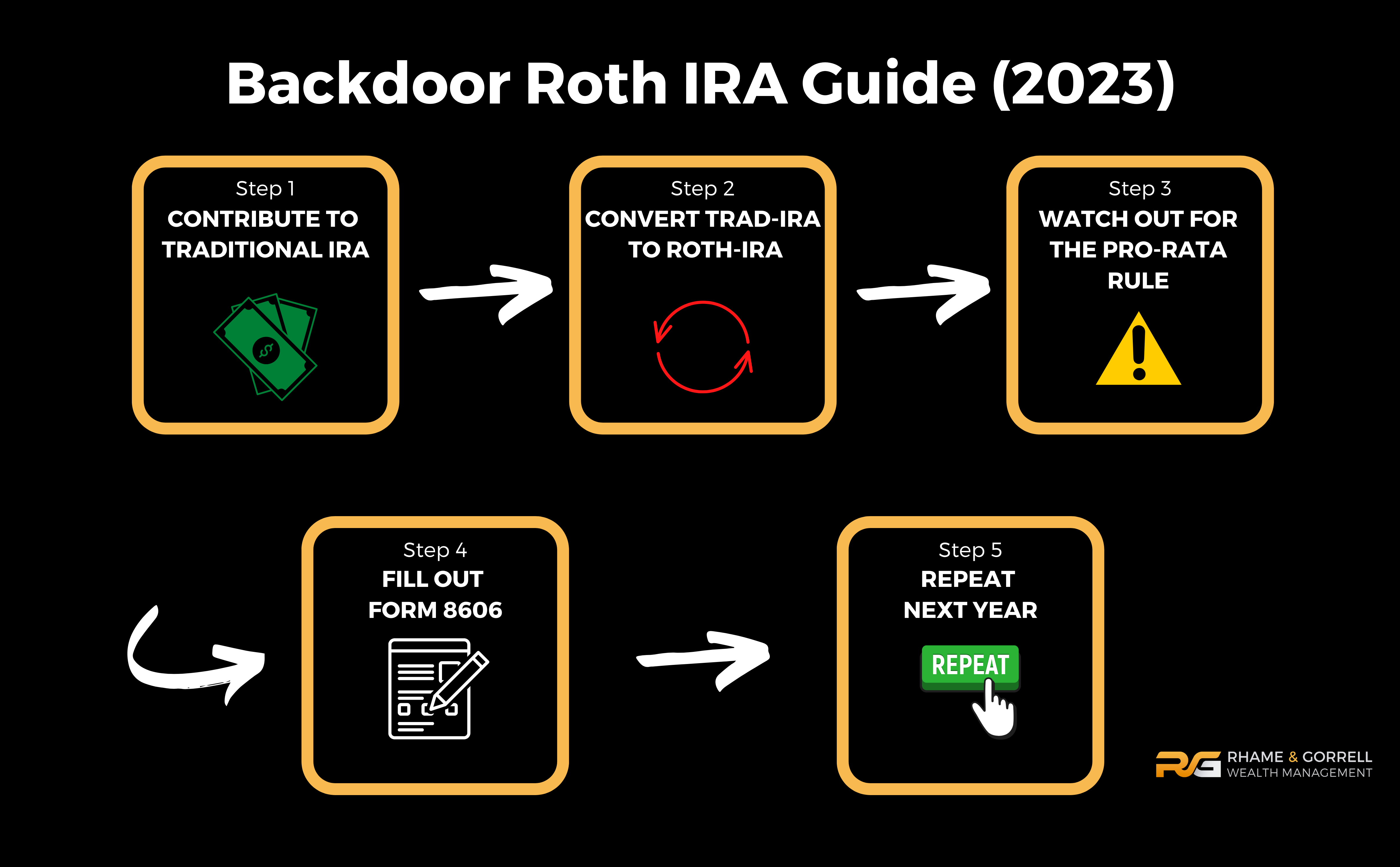

Mega Backdoor Roth Ira Limit 2024 Anny Sherri, How high earners can use a backdoor roth ira.

Source: kacieygiovanna.pages.dev

Source: kacieygiovanna.pages.dev

Backdoor Roth Ira Limit 2024 Faith Mirabel, What happens if i accidentally go over my mega backdoor roth ira conversation limit?

Source: timmyjackqueline.pages.dev

Source: timmyjackqueline.pages.dev

Backdoor Roth Contribution Limits 2024 Hally Kessiah, For employees age 50+, the limit is $26,000.

Source: ardisjqcarissa.pages.dev

Source: ardisjqcarissa.pages.dev

Mega Backdoor Roth Limit 2024 Cris Michal, What happens if i accidentally go over my mega backdoor roth ira conversation limit?

Source: lisbethwelysee.pages.dev

Source: lisbethwelysee.pages.dev

Backdoor Roth Limits 2024 Terry, For employees age 50+, the limit is $26,000.

Source: kacieygiovanna.pages.dev

Source: kacieygiovanna.pages.dev

Backdoor Roth Ira Limit 2024 Faith Mirabel, What happens if i accidentally go over my mega backdoor roth ira conversation limit?

Source: rgwealth.com

Source: rgwealth.com

Backdoor Roth IRA What Is It? When Is It Useful? RGWM Insights, For employees age 50+, the limit is $26,000.

Source: bilicynthie.pages.dev

Source: bilicynthie.pages.dev

Backdoor Roth Ira Limit 2024 Rahel Carmelle, How high earners can use a backdoor roth ira.

Source: nanniqadelina.pages.dev

Source: nanniqadelina.pages.dev

Backdoor Roth Ira Limits 2024 Joete Madelin, The max 401 (k) limit is $69,000 for 2024, which includes deferrals, employer matches, profit sharing and other deposits.

Category: 2024